When investing in Life Insurance, securing the highest returns in 2024 (this year) is a very important concern for many policyholders. Life Insurance Corporation (LIC) is the country’s largest and most trusted insurance company, offering numerous policies to meet diverse financial goals. This article will explore which LIC Policy gives the highest returns in 2024 (this year), providing you with crucial insights to make an informed decision.

Understanding LIC Policies and Highest returns in 2024

It’s important to understand the two main categories of LIC Policies that give the highest returns in 2024.

These include endowment, money-back, and whole-life plans, which offer insurance and savings with guaranteed returns and bonuses.

These are market-linked plans where the returns depend on the performance of the underlying investment funds.

Top LIC Policies for High Returns

1. LIC Jeevan Shanti

LIC Jeevan Shanti is a single premium annuity plan offering various options for immediate and deferred annuity. It is suitable for individuals looking for a stable income post-retirement. The highest returns in 2024 are not market-linked but the policy offers attractive guaranteed returns, especially under the deferred annuity option.

2. LIC Jeevan Umang

LIC Jeevan Umang is a whole life policy providing coverage up to 100 years of age. It combines income and protection offering annual survival benefits from the end of the premium payment term till maturity and a lump sum maturity benefit. The policy also accuses bonuses making it a popular choice for long-term financial with the highest returns in 2024.

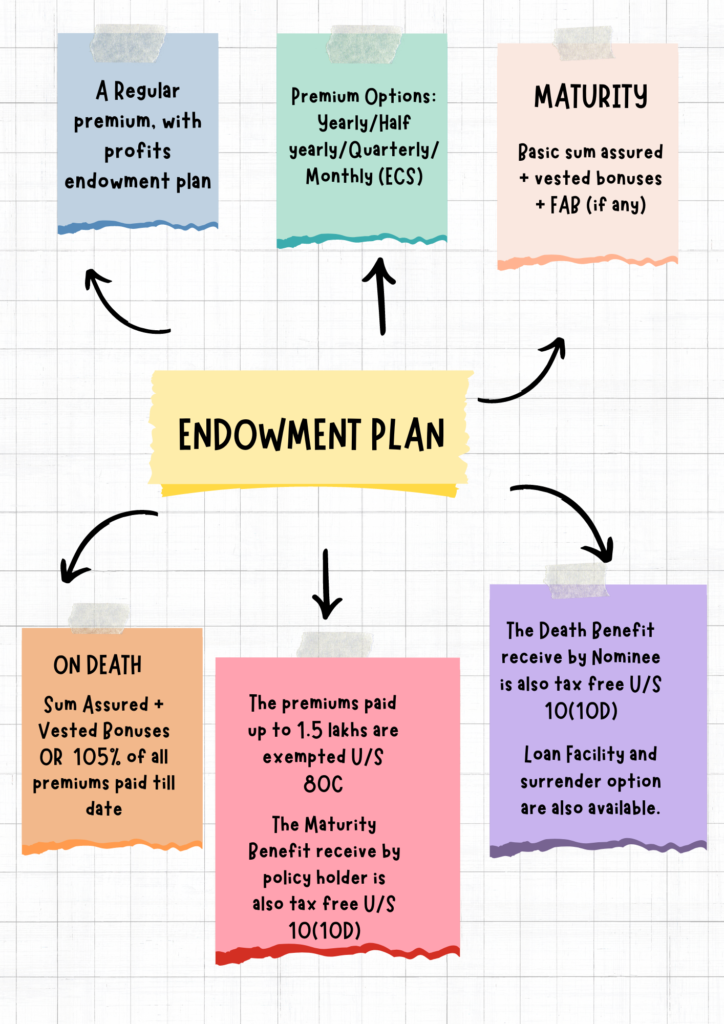

3. LIC New Endowment Plan

The LIC New Endowment Plan is a traditional plan that provides a combination of protection and savings. It offers a lump sum amount at the end of the policy term along with bonuses. This plan is ideal for those looking for a low-risk investment with decent returns and life cover.

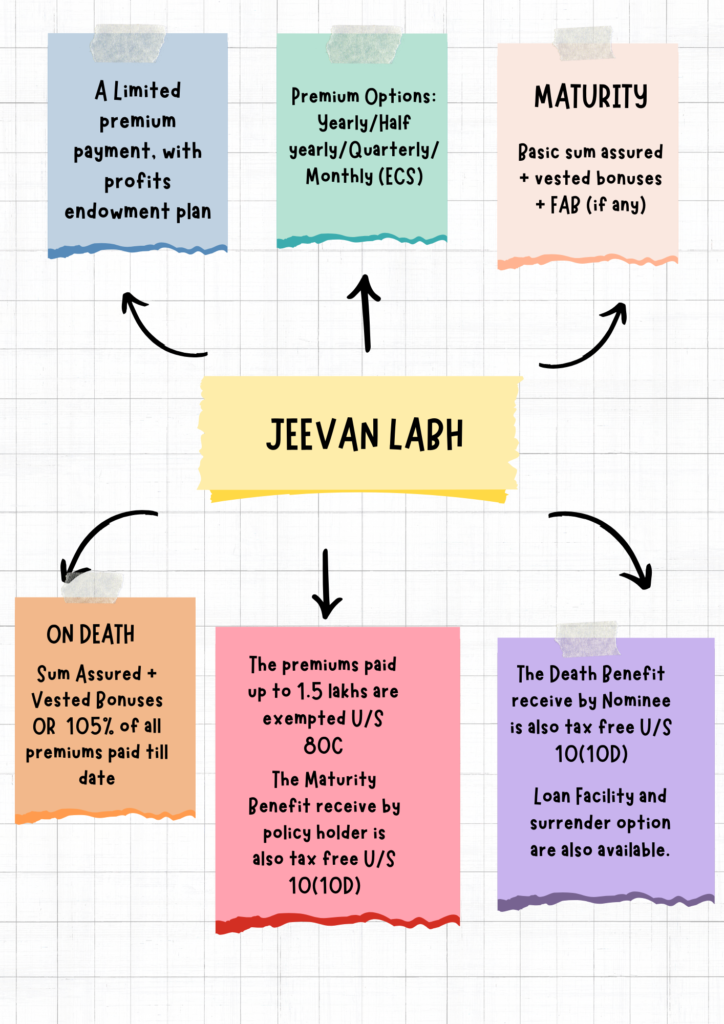

4. LIC Jeevan Labh

LIC Jeevan Labh is a limited premium paying, non-linked with-profits endowment plan, it offers a substantial amount on maturity or in case of the policy holder’s demise within the policy term. This plan is favored for its high returns, which include both guaranteed benefits and bonuses.

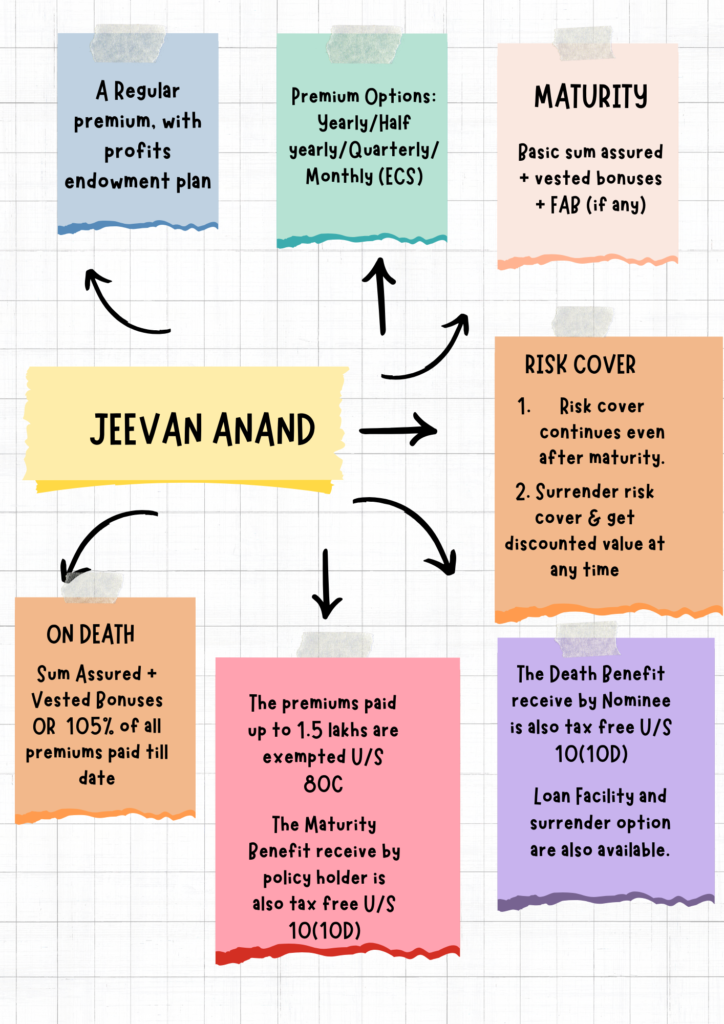

5. LIC New Jeevan Anand

LIC New Jeevan Anand is a participating non-linked plan offering the dual benefit of protection and savings. The policy provides financial protection against death throughout the lifetime of the policyholder with the provision of lump sum payment at the end of the selected policy term in case of survival. In Other words, we can say consistent bonuses, making it a strong contender for high returns.

Factors Influencing Returns

The returns on LIC policies are influenced by several factors.

LIC declares bonuses annually for its participating policies. The Higher the bonus rate, the better the returns.

Longer-term policies generally acquire higher bonuses and returns.

Policies with shorter premium terms but longer coverage periods tend to offer better returns.

Endowment and whole-life plans offer guaranteed returns, while ULIPs offer market-linked returns, which can be higher but come with higher risks.

Choosing the Right Policy

Selecting the right LIC policy for high returns depends on your financial goals, risk appetite, and investment horizon. If you prefer guaranteed returns with low risks, traditional plans like LIC New Jeevan Anand or LIC Jeevan Labh are best.

Conclusion

Investing in LIC policies can be a strategic move for long-term financial planning. Some LIC Policies like LIC Jeevan Umang, LIC New Endowment plan, and LIC New Jeevan Anand stand out for offering high returns through a mix of guaranteed benefits and bonuses. Evaluating your personal financial needs and consulting with an insurance agent can help you choose the best LIC Policy to maximize your returns.